There’s no better time than now to purchase the capital equipment you know you will need before the end of the year. By taking advantage of the Section 179 Deduction and Bonus Depreciation you will enjoy significant savings from your equipment purchases. This is a use-it-or-lose it write off that ends December 31, 2017, so get off the hump and place your orders now to ensure delivery before the end of the year.

Section 179 at a Glance for 2017

2017 Deduction Limit = $500,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2017, the equipment must be financed/purchased and put into service between January 1, 2017 and the end of the day on December 31, 2017.

2017 Spending Cap on equipment purchases = $2,000,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive”.

Bonus Depreciation: 50% for 2017

Bonus Depreciation is effective through 2019. Businesses of all sizes are able to depreciate 50% of the cost of equipment acquired and put in service by December 31, 2017. It is generally taken after the Section 179 spending cap is reached and is available for new equipment only. Bonus depreciation will phase down to 40% in 2018 and 30% in 2019.

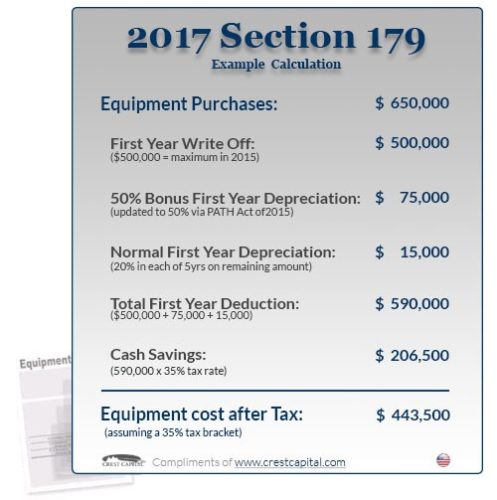

Here is an updated example of Section 179 at work during this 2017 tax year.

The above is an overall, “simplified” view of the Section 179 Deduction for 2017. For more details on limits and qualifying equipment, as well as Section 179 Qualified Financing, please visit www.section179.org

Contact us today to discuss how Lancaster Products can work with you to best finance the purchase of our products.

717-273-2111